Money transfer from Saudi Arabia to India is a necessity for millions of workers, professionals, and families. In 2025, remittance technology has become faster and cheaper, but costs still differ depending on the method you choose. Below, we break down the most effective options today, plus useful tips, do’s and don’ts, FAQs, and a comparison table.

These digital platforms are among the cheapest. They use transparent pricing, show you the real exchange rate, and let you pay via bank account or debit card. Transfers usually reach Indian bank accounts within minutes to a day.

👉 Best for: Low cost, small to medium transfers.

Saudi banks such as Al Rajhi, NCB, and Samba can wire money directly to Indian banks. This method is safe and suitable for large amounts, but slower (2–5 business days) and often more expensive due to hidden exchange-rate margins.

👉 Best for: Large, infrequent transfers where reliability matters more than price.

If your recipient doesn’t have a bank account, cash pick-up is still useful. Money is available within minutes at thousands of outlets in India. However, fees and exchange-rate markups can be high.

👉 Best for: Emergencies or recipients without access to banking.

India’s Unified Payments Interface (UPI) has expanded globally. Several remittance partners now credit funds instantly to Indian UPI-linked bank accounts. Fees are low, transfers are fast, and convenience is high.

👉 Best for: Quick, everyday transfers when your provider supports UPI.

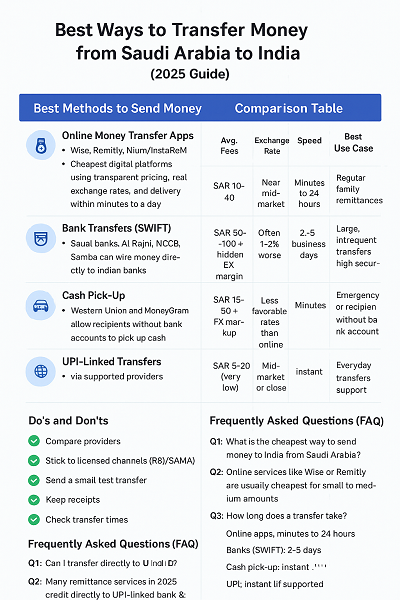

| Method / Provider Type | Avg. Fees | Exchange Rate | Speed | Best Use Case |

|---|---|---|---|---|

| Online Apps (Wise, Remitly, Nium) | SAR 10–40 (varies by amount) | Near mid-market rate (very transparent) | Minutes – 24 hrs | Regular family remittances, small–medium transfers |

| Bank Transfers (SWIFT via Al Rajhi, NCB, Samba) | SAR 50–100 + hidden FX margin | Often 1–2% worse than mid-market | 2–5 business days | Large, infrequent transfers; high security |

| Cash Pick-Up (Western Union, MoneyGram) | SAR 15–50 + FX markup | Less favorable rates than online apps | Minutes | Emergencies, when recipient has no bank account |

| UPI-Linked Transfers (via supported providers) | SAR 5–20 (very low) | Mid-market or close | Instant | Everyday transfers directly to UPI-linked bank accounts |

(Figures are approximate and vary depending on provider, transfer amount, and daily SAR/INR rate. Always check before sending.)

Compare providers before sending.

Stick to licensed channels approved by RBI (India) and SAMA (Saudi Arabia).

Send a small test transfer before a large one.

Keep receipts for tax and compliance.

Check transfer times in advance.

Don’t use hawala or unregulated agents — risky and illegal.

Don’t ignore exchange rates — fees alone don’t tell the full story.

Don’t delay transfers until last minute, compliance checks may cause delays.

Don’t mix personal and business remittances.

Q1: What is the cheapest way to do money transfer from Saudi Arabia to India?

Online services like Wise or Remitly are usually the cheapest for small to medium amounts.

Q2: How long does a transfer take?

Online apps: minutes to 24 hours.

Banks (SWIFT): 2–5 days.

Cash pick-up: instant.

UPI: instant (if supported).

Q3: Is there a limit to how much I can send?

No strict cap, but large amounts need proper documentation under SAMA (Saudi) and RBI (India) rules.

Q4: Are remittances taxable in India?

Money sent to family is not taxed as income. Large gifts or investments may attract taxes.

Q5: Can I transfer directly to UPI ID?

Yes. Many remittance services in 2025 credit directly to UPI-linked bank accounts instantly.

As of September 2025, here’s the best way depending on your needs:

Cheapest & fair rates: Online apps (Wise, Remitly, Nium).

Fast cash pick-up: Western Union / MoneyGram.

Large secure transfer: Bank SWIFT.

Everyday instant transfers: UPI-enabled remittance partners.

Always check both fees and exchange rates, that’s what really decides how much money reaches your family in India.

Important websites to visit –